We don't know if you saw the news on this company but they reported Q1 Revs of $41 Million!!!

That's not a joke! our long term alert is delivering on all fronts!!

The stock has retraced the past few weeks creating some interesting opportunities!

It's time to put this back on your RADAR!!

OTC:BSEM TO THE MOON!!

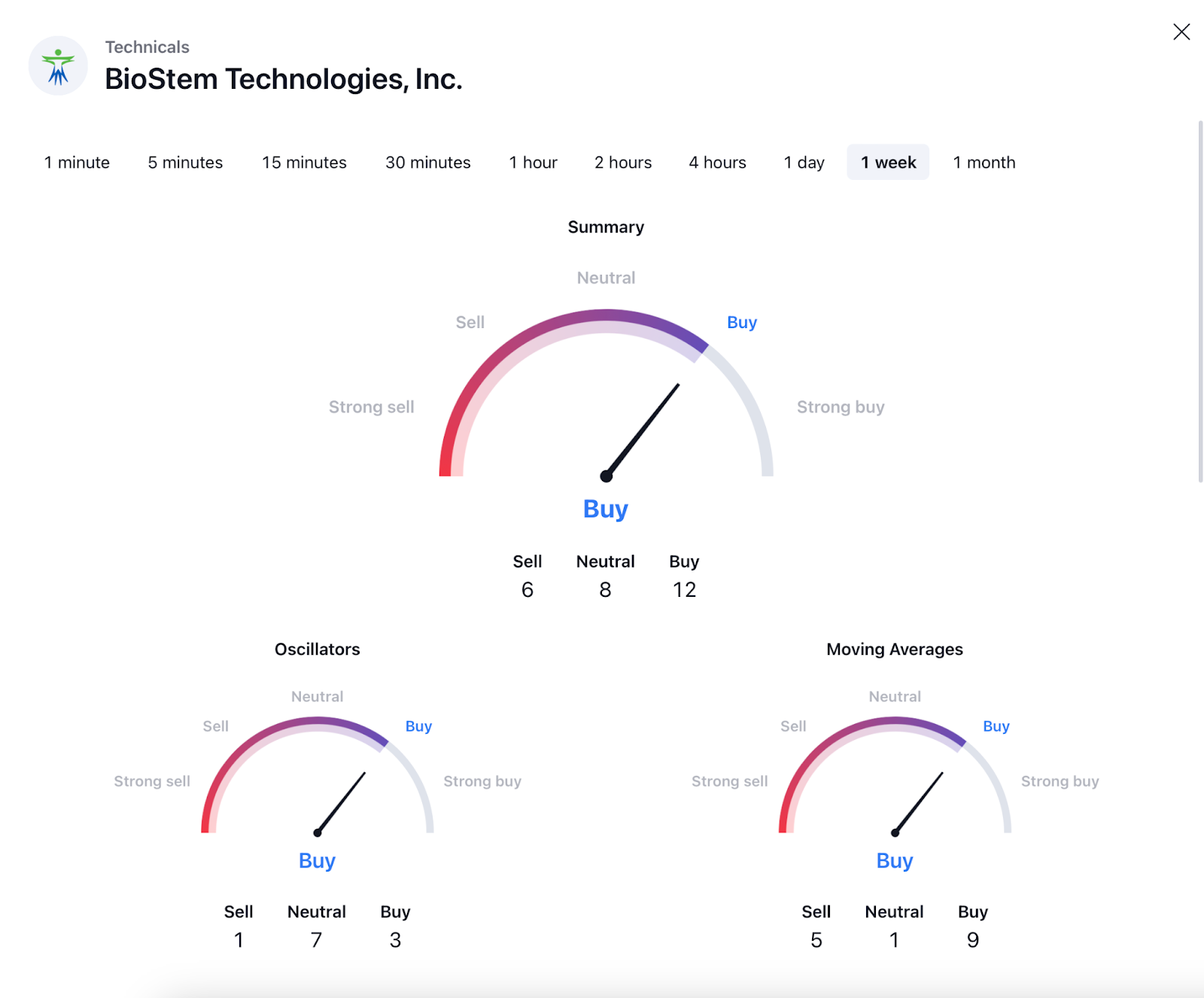

The chart and technicals on this little beauty look amazing!!

BIOSTEM TECHNOLOGIES INC. : AN EMERGING COMPANY IN THE MEDTECH SPACE THAT CARRIES AN $23.25 ZACKS PRICE TARGET AND IS SEEING ITS REVENUES INCREASE WITH PURCHASE ORDERS.

The MedTech sector is often overlooked but is just as innovative as many of the top tech names. Two massive multi-billion-dollar markets for its regenerative therapies position BioStem Technologies Inc. (OTC: BSEM) as one a top medtech stock to watch.

The company just released its Q1 EARNINGS which shocked the market. with Revenues tallying up to $41 Million in the first quarter of 2024. The last 6 months have a been a pivotal time for (OTC:BSEM) As the company continues to reach new milestones.

The medtech arena is not the easiest to navigate given how many kinds of companies are in it. It's all about finding emerging players like BSEM who have successfully navigated the regulatory process (a real barrier to entry) and show real growth.

Zack's Small Cap Research recently increased its price target to $23.25, recognizing the company's value after it reported Q1 financial results.

These results have led to Zack's Small Cap Research increasing its price target for the third time in the last few months!

This notable research firm sees the VALUE!

"We reiterate our belief the BSEM is still underpriced even after its recent move higher and continues to represent a good opportunity at recent prices for investors to get in before what we believe will be a more aggressive move higher in the not-too-distant future. The vision management has for the company's products and the focus they are using to deliver results are encouraging and are now being rewarded by increased demand. As such, we suggest investors with a modestly higher risk tolerance take a look at BSEM."

- Zack's Small Cap Research

BSEM states its mission is "to discover, develop and produce the most effective regenerative medicine products in the world," and Zack's believes that the company is well on its way to achieving that goal—providing to investors what the firm believes is an opportunity to invest in a company that is both providing a vital service to the human population and providing economic value to shareholders when doing so!

The price increase from Zack's follows the company's Q1 earnings and other details as follows:

- Revenues of $41.9 million represented a nearly 71-fold increase over the year-ago period.

- Margins improved to 95% and on the call following the release, management noted that margin rate should be continued at roughly the current level.

- The company announced that the US Patent Office has prioritized the examination of the patent for BioREtain processing technology.

- The company also reminded investors that it has retained an experienced clinical research professional to lead BioStem's Diabetic Foot Ulcer and Venous Leg Ulcer trials.

- These trials are an attempt to proactively address potentially changing reimbursement requirements by Medicare Administrative Contractors.

- Proposals have been made to sharply cut the number of approved treatments and, while the industry is largely fighting against such a drastic cut, BSEM is preparing for whatever decision ultimately comes down.

- The company posted its first positive net income reading in a quarter by earning just over $4.4 million.

- The compan yalso recently announced that an extensive two-year audit had been completed in preparation for moving BSEM to a national exchange. On the call following the release, management noted that the move was likely to be sooner rather than later!

BioStem Technologies Inc. also demonstrated significant financial and operational progress in 2023 as highlighted below:

- The company reported a remarkable year-over-year net revenue increase of 1,355% to $11.5 million in the fourth quarter, with the gross profit margin reaching 95% of revenue, up from 84% the previous year.

- Operationally, BioStem expanded its capabilities by acquiring assets from Auxocell Laboratories, launching AmnioWrap2 nationwide with Venture Medical LLC, initiating a clinical trial for diabetic foot ulcers (DFU), and securing commercialization agreements for Avenova Allograft™ with NovaBay.

- The company's products also gained listings with the U.S. Department of Defense and Veterans' Administration, achieved CMS reimbursement for Vendaje AC® and AmnioWrap2, and strengthened its leadership by appointing two new board members.

"2023 was a year of tremendous growth, progress and achievement for BioStem. This growth is primarily attributed to the successful launch of Amniowrap2™, our innovative placental-derived allograft product designed to address a broad spectrum of wound applications. A significant factor contributing to this success has been the widespread acceptance and utilization of Amniowrap2™ by medical professionals, underscoring its effectiveness and growing prominence in the healthcare industry. We remain committed to our mission of delivering unparalleled wound care solutions for patients and healthcare professionals, and look forward to broadening our reach into new markets in the next year."

CEO Jason Matuszewski

Recent Milestones:

- Preliminary net revenue for the fourth quarter 2023 was $11.5 million, (UNAUDITED) an increase of 1,351% from the same period in 2022. Total preliminary net revenue reached $16.7 million (UNAUDITED), in the fiscal year concluding on December 31, 2023, representing a 142% increase compared to the previous year.

- The company announced in January 2024 that its Healthcare Common Procedure Coding System code for Vendaje AC became effective and that the Center for Medicare Services established national pricing for AmnioWrap2 in all 50 states and territories.

- In November 2023, BioStem was awarded a Q code for VENDAJE AC® by the Centers for Medicare and Medicaid Services (CMS). The Healthcare Common Procedure Coding System (HCPCS) code will be effective January 1st, 2024, and will ensure broader access to the company's Vendaje® product.

- Also in November, the Company closed an oversubscribed private placement for gross proceeds of $2 million.

- In October 2023, BioStem announced the opening of the first site for its clinical trial, evaluating its Vendaje® tissue allograft in the treatment of diabetic foot ulcers (DFU). The Company received an Investigational Review Board (IRB) for the landmark study in September 2023.

- In September 2023, the Company entered an agreement with leading US wound market solutions provider, Venture Medical, LLC., for the nationwide release of its innovative product, AmnioWrap2™. Venture Medical will act as BioStem's commercial partner as it works to bring its product portfolio to healthcare providers and patients around the country.

- Also in September, BioStem entered a commercialization agreement with NovaBay Pharmaceuticals for its Amniotic Tissue Allograft, which is intended for use as a protective covering during the repair of ocular surfaces. NovaBay intends to commercialize the prescription-only product as Avenova Allograft to leverage its Avenova eye care brand and encourage use with other Avenova products. Medically necessary procedures with the Avenova Allograft will be reimbursed through Medicare.

- In September 2023, the Company was successfully listed on key government contract vehicles, on the Department of Defense's Distribution and Pricing Agreement (DAPA), the Department of Veterans Affairs Federal Supply Schedule (FSS), and the Defense Logistics Agency's ECAT system. This listing was made possible by BioStem's Service-Disabled Veteran-Owned Small Business (SDVOSB) exclusive partner, Lovell Government Services.

Being awarded a Q code is a major milestone for BSEM!

It applies to drugs, biologics, and medical equipment and services that are not identified by the national code needed for Medicare claims processing. It allows these "Q" products to be reimbursed by Medicare.

Zacks Smallcap Research previously noted: "With the company's recent announcement of a Q code, we believe rapid growth is set to continue and are raising our valuation level as a result."

With BSEM's revenues skyrocketing, the company securing a CMS Q code, game-changing partnerships, a successful capital raise, and the start of a crucial clinical trial for diabetic foot ulcers… BSEM is a stock to watch.

What is the Company doing?

Biostem Technologies is a leading innovator focused on harnessing the natural properties of perinatal tissue in the development, manufacture, and commercialization of allografts for regenerative therapies.

The company is providing a vital service to the human population while working to provide economic value to shareholders as well.

BSEM manufactures perinatal tissue allografts and is focused on the diabetic wound care market and the surgical wound care market.

What is the company's mission? "To discover, develop, and produce the most effective regenerative medicine products in the world."

SEE THE STOCK CHART

Notable clients and partners include:

The Back Story

BioStem CEO Jason Matuszewski and Chief Operating Officer Andrew Van Vurst co-founded the company in 2014. When Van Vurst's father developed side effects from radiation treatment for cancer, resulting in partial paralysis and speech impairment, Van Vurst returned from the military to explore treatment options that would help his father regain motor function, speech and overall quality of life.

These included regenerative medicine, utilizing material derived from a human umbilical cord, that was being used to help restore tissues or organ damage because of age, disease, injury or other issues.

In 2013, Van Vurst and his father discovered South Florida-based Caribbean International Holdings, a provider of stem cell treatments.

The regenerative medicine therapy proved to be a great success for Van Vurst's father, who regained his speech, and vastly improved his motor skills and overall quality of life. Due to the success of the treatment, Van Vurst and his father developed a passion for regenerative medicine and BioStem was born.

Future Medicine: Regenerative Therapies

It's no secret that the human body has an amazing ability to heal itself. You may have heard the term regenerative medicine before. It's basically where the body uses its own systems to rebuild tissues and organs.

With its potential to heal, regenerative medicine has become a VERY hot topic and is expected to revolutionize healthcare.

The market for regenerative medicine is expected to experience significant growth over the next few years. It comes as no surprise that some of the biggest companies in healthcare are working hard to make advances in this vital space. This includes major players like Amgen, Sanofi, and Gilead Sciences.

A report from Grand View Research projects that the global stem cell market will reach a massive US$18.4 billion by 2028.

The research firm sees "the rising number of stem cell banks, growing focus on increasing therapeutic potential of these, and extensive research for the development of regenerative medicines" as drivers of this market.

Grand View Research has also highlighted that many studies have been conducted over the years to assess the true potential of stem cells, leading to a variety of applications in the fields of genetic disease treatment, neurological disorders, oncology, and organ regeneration.

SEE THE STOCK CHART

Harnessing Placental Tissue for Regenerative Therapies

BSEM manufactures tissue allografts that come from the human placenta. This is essentially a tissue transplant product from the placenta. In the space of skin substitutes, it is like xenografts or grafts from an animal.

What is an allograft?

An allograft is a tissue that is transplanted from one person to another. The prefix allo comes from a Greek word meaning "other." (If tissue is moved from one place to another in your own body, it is called an autograft.) More than 1 million allografts are transplanted each year.

The Company's Allografts Are Not Just Any Allografts….

They Are Best-In-Class Placental Tissue Allografts!

The proprietary BioRetain® processing method.

BioRetain® has been developed by applying the latest research in regenerative medicine, focused on maintaining growth factors and preserving tissue structure.

The company's portfolio of quality brands includes VENDAJE™, VENDAJE™ AC,VENDAJE™ OPTIC and AMNIOWRAP2.

Each BioStem Technologies placental allograft is processed at the Company's FDA-registered and AATB-accredited site in Pompano Beach, Florida.

Already Working with Notable Clients and Partners, BSEM is Paving the Way in Modern Medicine with Substantial Growth Potential!

BSEM is focused on the application of tissue engineering in wound healing and has curated a suite of versatile products called Vendaje.

Vendaje is the company's primary product and harnesses elements of perinatal tissue and the body's innate biology to repair and restore damaged tissue in wounds, resulting in speedier healing with reduced pain.

Vendaje comes in several different forms and sizes and is a human connective tissue matrix comprised of amniotic tissue. This amniotic tissue is processed using the company's proprietary BioRetain process, which creates a dehydrated human amniotic membrane allograft.

Placentally-derived human amniotic membrane (AM) is a source of pro-healing growth factors and anti-inflammatory cytokines and has successfully been used in regenerative medicine for over a century.

Vendaje is the result of the modernization of this science.

- VENDAJE™ is offered to all Medicare providers across the United States. On January 1, CMS established and published the national pricing data for reimbursement based on the Average Sales Price ("ASP") of VENDAJE™. Establishing national pricing for VENDAJE™ enables BioStem to offer its product to all Medicare providers across the U.S.

- VENDAJE™, VENDAJE ACTM, VENDAJE OPTICTM, and AMNIOWRAP2TM are the only allografts available that leverage the company's proprietary BioREtain processing technology.

BSEM has entered an agreement with leading US wound market solutions provider, Venture Medical, LLC., for the nationwide release of its innovative product, AmnioWrap2™.

A leading wound market solutions provider called Venture Medical, LLC., will lead the company's commercialization of AmnioWrap2™!

AmnioWrap2 is a versatile allograft solution for wound applications. It is an advanced biologic skin substitute that is meticulously processed to offer an extensive range of wound healing and wound care solutions.

"AmnioWrap2™, is the latest addition to BioStem's product portfolio, and is developed using its proprietary BioREtain process.

This process creates an allograft derived from amniotic tissue, optimized to cater to diverse wound care applications."

The launch of AmnioWrap2 signifies a pivotal milestone as the company expands its spectrum of innovative solutions within the wound care market.

According to the company, early users of AM for wounds and post-surgical applications noted how the membrane seemed to disappear and integrate with the patient's own tissue without a host reaction. This apparent immune neutrality is a result of mechanisms that suppress and modulate the immune system.

The increased adoption of perinatal tissues has allowed for its significant penetration into the multibillion-dollar soft tissue repair market, which is expected to reach around $8.6B by 2030!

As more doctors become familiar with the BSEM technology, it could open doors to many revenue opportunities!

SEE THE STOCK CHART

Two Big Markets

Perinatal tissue allografts have been successfully used since the early 1900's as an alternative modality for the treatment for chronic wounds.

More recently physicians have used these products to treat ocular surface disorders, chronic non-healing diabetic wounds, and in a variety of surgical procedures.

The market for products BSEM has developed and is continuing to develop is extensive and this cutting-edge technology can prove to be a game-changer to many patients suffering from painful and slow recoveries.

Both the diabetes wound care market and surgical recovery wound care market are growing at a tremendous rate.

Because diabetes and issues from diabetes are increasing worldwide, this offers an opportunity for BSEM's allografts to help patients.

- The global wound care market in terms of revenue was estimated to be worth $20.8 billion in 2022 and is poised to reach $27.2 billion by 2027, growing at a CAGR of 5.4% from 2022 to 2027.

- The US advanced wound care market in terms of revenue was estimated to be worth 11.2 billion in 2022 and is poised to reach 17.7 billion in 2027 at a compound growth rate (CAGR) of 9.4% from 2022-2027.

- The global diabetic foot ulcer treatment market size was valued at $4.67 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030.

There is promising potential for BSEM to impact patients and expand the company's business in an exponential way as more doctors become familiar with the company's technology!

SEE THE STOCK CHART

More Reasons to Have BSEM on Your Radar:

- Working with notable clients and partners including the Center of Medicare Services (CMS), and the U.S. Department of Veterans Affairs (VA).

- Specially trained salespeople recently installed could be very effective in explaining the benefits available from using the company's product. BSEM has added industry veterans Mirlene Guerre as Vice President of Sales and Neal Bhattcharya as Vice President of Marketing. Ms. Guerre has extensive experience leading sales teams and organizations in wound care, burn, plastics, general, and oral/ent surgical markets. Mr. Bhattacharya has held progressive positions in marketing for well-known national brands in both consumer packaged goods and medical device companies, including Kimberly-Clark, Novartis, Covidien and Trividia Health, Inc.

- The company has entered into an Agreement to acquire the majority of the assets of Auxocell Laboratories, Inc., a leading solid tissue processing equipment manufacturer. The acquisition will enable BSEM to expand its intellectual property portfolio, both domestic and foreign, in the perinatal tissue space and provide additional value to clients and shareholders.

- To date, the company has produced over 20,000 allografts, including its own Vendaje® line of products as well as contract manufacturing for many key industry players.

- BioStem Technologies' quality management system and standard operating procedures have been reviewed and accredited by the American Association of Tissue Banks ("AATB®"). The company's facility is also FDA-accredited.

In Summary

After a year that was marked by robust revenue growth, BSEM is navigating 2024 for another year of success. There could be an uplisting to a senior exchange on the horizon!

As regenerative medicine continues to find its way into the mainstream, emerging biotech company BioStem Technologies, Inc. (OTC: BSEM) is making waves for its focus on harnessing elements of perinatal tissue derived from the human placenta for manufacturing structural tissue allografts to heal wounds.

- The company's products have the potential to save millions of lives while building market capitalization growth for BSEM in the process.

- With a highly experienced commercial team, the company aims to stay ahead of the competition through the company's unique processes and versatile offerings in wound healing, focusing on TWO big markets.

- Revenues are surging and future growth looks encouraging with all of the milestones recently achieved.

- Allografts derived from the human placenta, known as perinatal allografts, have been in use for over a century for a wide range of clinical specialties and BSEM is looking to ride the upward growth trajectory of the soft tissue market.

- Being offered to all Medicare providers across the United States could make sales increase dramatically! Especially now that the company has secured a Q code.

- Zack's Small Cap Research has a $23.25 price target on the stock right now.

Many investors may overlook MedTech healthcare stocks, but these companies often demonstrate unlimited potential. Unlike their pharma counterparts, MedTech healthcare stocks are often nimbler and more innovative. These companies are leveraging global trends.

BioStem Technologies (BSEM) is actively working to reshape the future of medicine and is still at the beginning of its growth story!

Sign up to get a free investor package, and stay up to date with OTC: BSEM

Top of Form

Bottom of Form