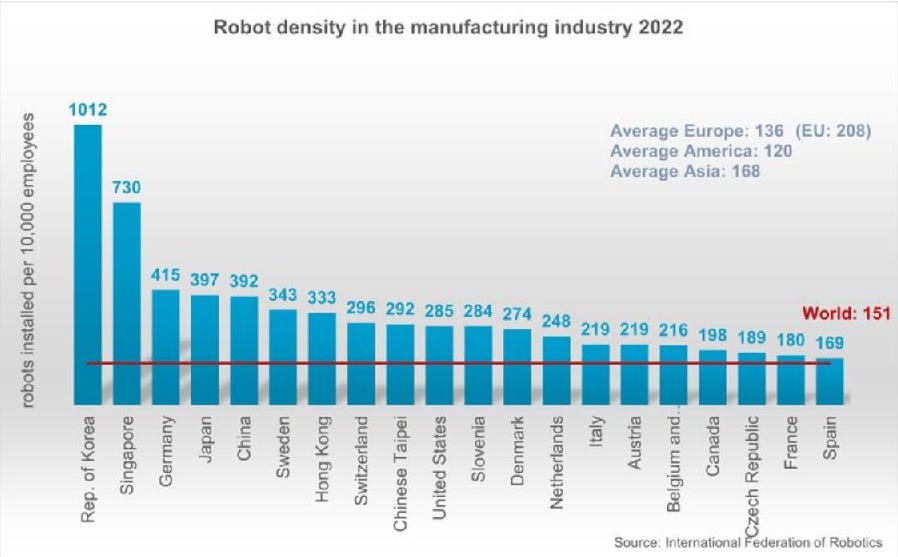

China Will More Likely Grow Rich Before It Grows Old“New Productive Forces” are dramatically upending the clichéBy: Xiaochen SuIt appears that, contrary to widespread western belief, China is restructuring how state capital and regulatory resources are allocated at a striking pace to prioritize growth, in the pursuit of sustaining future global dominance instead of falling into the demographic trap set by its declining population. Despite western expectations – or perhaps hopes – China is not going to grow old before it grows rich. It looks likely to go on growing steadily, with the fastest and biggest robotics implementation in the world replacing its human workforce, which is expected to decrease sharply in the coming years. That has unsettling political and economic implications for the West, particularly the United States, lulled into complacency by China’s property overhang debacle and its currently struggling economy The thesis that it won’t grow rich first seems to have plenty of empirical evidence behind its validity. Citing the correlation between aging and decreased economic growth in Japan and even the older parts of China itself, these analyses argue that with a fertility rate even below Japan’s, exacerbated by government policies that resulted in a demographic bulge toward males, and with no mass immigration to speak of, China will not have the manpower needed to keep its GDP per capita growing steadily enough in the coming years ever to reach the average of high-income countries. The headline numbers certainly add credence to the theory. Having begun its decline two years ago, China’s population is projected to continue the same trend, with the total population halving by 2100 despite intensive government campaigns to get women to have babies. The GDP growth rate, currently around the 5 percent mark, is expected to decline steadily to a little more than 3 percent by the decade's end. Without a dramatic increase in private consumption, a difficult task with a steadily declining population, it may not see a long-term growth above 2-3 percent, not much higher than the fully developed, matured economy of the United States, preventing China from ever surpassing America in total economic size. China also will find it necessary to vastly expand its social security net to care for its burgeoning numbers of the elderly, along with reforming its health care system, problems that Japan has been groping with for decades. In 2010, 7.6 workers were produced for each elderly person in China. By 2030, that figure will fall to 3.3, to 2.1 in 2040, and to 1.7 by 2050, meaning a massive social security network must come into bring in a country that for millennia has depended on family. Technological innovation dictates growth But to conclude that demographics dictate economic destiny is to forget economic history. Since the Industrial Revolution, economic growth has been much more aligned with access and control over innovative technology rather than the absolute figure of population growth. As recently as 1900, the United Kingdom, with a population then of a little more than 40 million, managed to generate economic output equal to China and India, the population and economic giants of the world since the dawn of civilization. The US, at the time, managed to double the British output with less than twice its population. The Westerners’ surging ahead had little to do with population growth and much to do with innovative industrial technology. Cotton mills, assembly lines, and division of labor at the heart of the new capitalist economy outcompeted, in production speed and price, the masses of manual artisans in cottage industries of the Orient. As Western industrial firms dominated global profits and market shares, the large populations of the Asian giants were anything but an advantage. The sheer number of people made poverty alleviation harder, leading to both countries ultimately turning to family planning and population control as solutions. It is this power of innovative industrial technology that China is betting on in the next phase of growth as its demographic dividend winds down. Although South Korea, Singapore, Japan, and Germany currently lead in robotics implementation, China is making a massive investment that has propelled it into fifth place in global standings despite its gigantic human manufacturing labor force of 38 million, according to the World Robotics 2023 report, presented by the International Federation of Robotics. In 2022, China’s investment in industrial robotics put the country in the top ranking of robot density, surpassing the United States for the first time. Latest figures put China at 392 in robotics density relative to the 10,000 workers, up from only 68 in 2016 while the US has fallen to tenth place in the world at 292. With 290,000 units installed last year, that was half the manufacturing robots installed worldwide, according to the IFR. Those figures, while they are the latest from the IFR, are more than a year old. President Xi Jinping has repeatedly spoken about the need for the country to invest in “new productive forces,” a set of cutting-edge manufactured goods that may see increased demand as the world shifts away from fossil fuels. From electric vehicles (EVs) and batteries to solar panels and flying cars, the Chinese government is restructuring how state capital and regulatory resources are allocated to prioritize their growth, with the explicit goal of sustaining future global dominance. Extra growth without extra workers While the term “new productive forces” may only have come into being in a speech by Xi in September 2023, their importance to the continued growth of the Chinese economy can already be felt. Based on the latest Q1 2024 data available, the new productive forces already make up 9.4 percent of the Chinese economy, up from next to nothing only a few years ago. The same data shows that the economic output of EVs, batteries, as well as service robotics that keep them producing, all grew by more than 20 percent in the period. These new sources of growth have offset the economic decline of the construction and real estate sectors as China’s property downturn continues. Moreover, new productive forces are emerging as sectors that can continue to grow without further stretching China’s working-age population are in decline since 2011. In particular, major Chinese EV producers such as Nio have touted their ability to increase production capacity by shifting toward more robot-centered production facilities so that they can meet targets to drastically reduce the number of human workers. The accompanying need for skilled workers to manage and improve the robots, meanwhile, plays into a much-ignored strength of China’s demographics: the continued growth in the number of university graduates, particularly, STEM PhDs. How far will these “new productive forces” take the Chinese economy? The answer will largely depend on how China handles the political repercussions of its global dominance of these sectors. US and EU tariffs on Chinese EVs and solar panels will force China to search for less profitable markets, either with underdeveloped demand stemming from low income, or, like China, population decline. Simultaneously, it is not yet a foregone conclusion that with the right industrial policy support, other countries cannot out-innovate, outproduce, and outcompete China in these sectors. But whether or not China remains its king, the emergence of “new productive forces” shows that, in China and elsewhere, a society can grow rich even when it grows old. Xiaochen Su, Ph.D. is a business risk and education consultant and a regular correspondent to Asia Sentinel. He previously worked in Japan among other countries throughout Asia. This is among the stories/excerpts we choose to make widely available.If you wish to get the full Asia Sentinel experience and access more exclusive content, please do subscribe to us for US$10/month or US$100/year. |