To support our work please consider becoming a paid subscriber to EconVue+

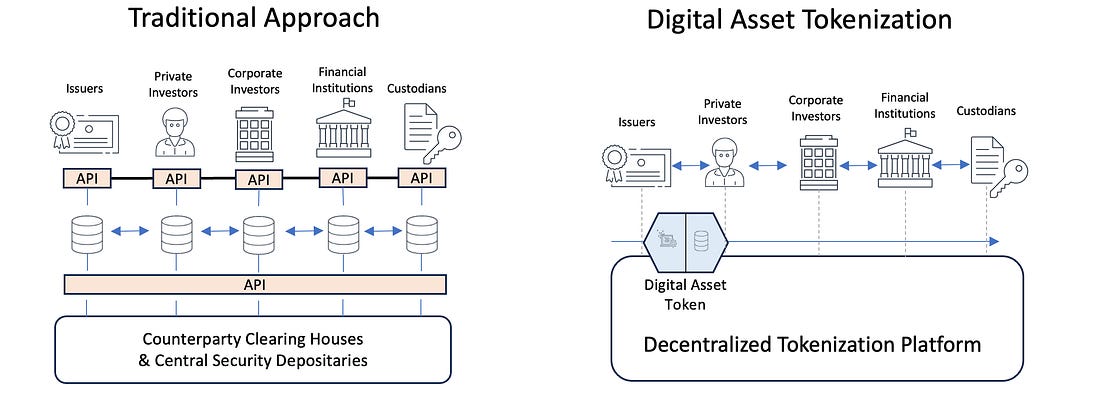

I. What is Tokenization?Tokenization, the recording of claims on real or financial assets on programmable platforms, represents the latest frontier in monetary innovation. This process allows the integration of messaging, reconciliation, and asset transfers in a single operation, replacing fragmented financial infrastructure with unified digital representations of financial claims. At the heart of the process are private unified ledgers using blockchains or distributed ledger technology. These functions run in parallel to the current monetary system, which ultimately uses public ledgers (such as central banks’ balance sheets) to fulfill them. The difference with tokens is that these ledgers can be processed by private entities independent of governments and monetary authorities. While this futuristic concept is already here, it represents the latest stage in a long evolution of the monetary system, which has always responded to technological progress. Like every stage of monetary and financial innovation, it brings with it risks and opportunities. In this series of posts, I will focus on a specific kind of monetary innovation, stablecoins. My analysis will cover the following:

Are Stablecoins Money, or Just Another Shiny Cyber Object?As a starting point, we can go back to the definition and functions of money. Throughout history, money has taken many different forms—shells, salt, precious metals, paper, fiat, deposits, electronic and digital. By definition, it is a generally accepted system for settling payments and extinguishing debt, and it is ultimately based on trust. Macroeconomics 101 teaches us that money has three functions: a unit of account, a medium of exchange and a store of wealth. At the center of the system is trust. Some assets fulfill one or more of these functions. However, only money fulfills all three simultaneously. More specifically, the foundation of the monetary and financial system is the ability to settle payments at par. In this relation, the latest Annual Report of the Bank for International Settlements, the BIS Annual Report 2025 identifies the three tests underlying a viable monetary system.

The current two-tier monetary system based on sovereign-issued fiat money fulfills these conditions. The central bank issues currency, while commercial banks create money by accepting deposits, which are accepted because they are settled at par and backed by reserves held by a central bank. Settlement of banking transactions occurs through the banks’ reserve accounts at the central bank, which acts as the clearing agent. Legacy Banking and the Logic of Fractional ReservesModern banking is based on the concept of ”fractional reserves”. This concept means that banks, which are required to honor any withdrawal by depositors, hold reserves that are only a fraction of the total amount of deposits that they hold. The reason is that not all depositors need access to their funds simultaneously. This structure, however, makes banks vulnerable to panics and runs, which can occur when a large number of fearful depositors seek to cash in their deposits which can lead to the collapse of a bank and even a broader crisis of the banking system, a banking panic, if the contagion spreads throughout the system. This is why banks are the most regulated sector of the economy. Banks are required to hold minimum levels of reserves (as a percentage of deposits), have sufficient capital, diversify their asset holdings, and practice risk management. In exchange, they have the backing of the monetary authorities in the form of liquidity as well as deposit insurance. Ultimately, the banking system represents a trade-off: commercial banks follow prudential rules in exchange for a safety net provided by the monetary authorities. Stablecoins: Banking Without the Safety NetStablecoins are a category of cryptocurrencies whose value is tethered to a real asset or group of assets. The issuer essentially guarantees that the stablecoin can be exchanged at par for the underlying asset. The issuer takes deposits in stablecoins, which it invests in assets such as US Treasuries. In effect, it acts as a bank, making a profit on the spread between interest earned on assets and interest paid (typically zero) on deposits. The critical difference between stablecoins and fiat money is that stablecoins are issued by private entities, with settlements occurring outside the jurisdiction of the country’s monetary authority or central bank. There are three categories of stablecoins:

Obviously, only the first category merits being classified as a form of money. Currently, there are about 240 stablecoins in circulation, with a total value of $300 billion. Two issuers, Tether and USDC, control roughly 83% of the total market, highlighting the growing concentration of this ecosystem. Stablecoins as Financial InnovationStablecoins are a way to use technology to create cheap, efficient, and broadly accessible platforms for domestic and international settlements. The technology can go beyond currency to provide platforms for issuing and holding other securities such as bonds, stocks, and money market funds. They also provide a fast and low-cost system for settling foreign currency trades. Stablecoins-based banking, despite its technology shine, is very similar to the US “Wild-west” banking system that prevailed in the United States prior to the Banking Act of 1863. Prior to 1863, banks issued their own bank notes in exchange for deposits of gold. In effect, that meant that the banknotes issued by any bank often could not be used for payment at par outside the jurisdiction of the bank. The system was unregulated and lacked a lender of last resort, which led to frequent bank runs and financial crises. The Banking Act of 1863, created the system of “national” banks, regulated by the newly-established Comptroller of the Currency. It also set a tax on all banknotes issued by banks not considered “national”, which effectively eliminated most bank notes. Banking regulation evolved further with the creation of the Federal Reserve System in 1913 and the New Deal banking reforms, including the establishment of deposit insurance. The question is whether or not the stablecoins system can survive without being brought under the regulators’ umbrella. In order to answer this question, we need to look at the benefits and risks attached to stablecoins, an issue which will be addressed in Part II of this post.

📍Chicago You can also follow Karim on Random Access Economics: Related Stories on econVueYou're currently a free subscriber to econVue. For the full experience, upgrade your subscription. |